Insights

Expert Spotlight: Navigating APAC's next dealmaking wave

December 13, 2023 | Blog

Expert Spotlight: Navigating APAC's next dealmaking wave

Asia Pacific’s dealmaking landscape has seen a decline in activity in 2023 amid rising interest rates, regulatory scrutiny, and economic uncertainty. This is against the backdrop where worldwide M&A volumes hit a 10-year low in Q3 2022, while private equity deal value dropped 41% versus last year, per the London Stock Exchange Group data.

In APAC specifically, China's economic troubles and geopolitics are dampening investor moods. Chinese cross-border M&A has hit decade lows as US-China tensions give some acquirers cold feet. Meanwhile, foreign investment in China has slowed as well.

Bright spots beckon beyond the M&A gloom

That said, pockets of opportunity remain across the region for dealmakers willing to adapt to the new, challenging environment. Southeast Asia retains strong appeal. Japan is attracting more tech and private equity money as firms diversify from China. India too is benefitting from China+1 strategies, while domestic consumption remains strong.

Recently, Datasite and Financial Times co-hosted a webinar on M&A activity and trends in the APAC region and strategies dealmakers can leverage to revive dealmaking in 2024. Financial Times’ Asia Financial Correspondent Kaye Wiggins moderated the discussion with an esteemed panel of M&A experts:

- Miranda Zhao, Head of Mergers & Acquisitions, Asia Pacific, Natixis CIB

- Nozomi Oda, Partner, Tokyo, Morrison Foerster

- Josie Ananto, Asia-Pacific Transaction Strategy & Execution Leader, Ernst & Young

- Desmond Chua, Head of APAC, Datasite

Navigating the new normal

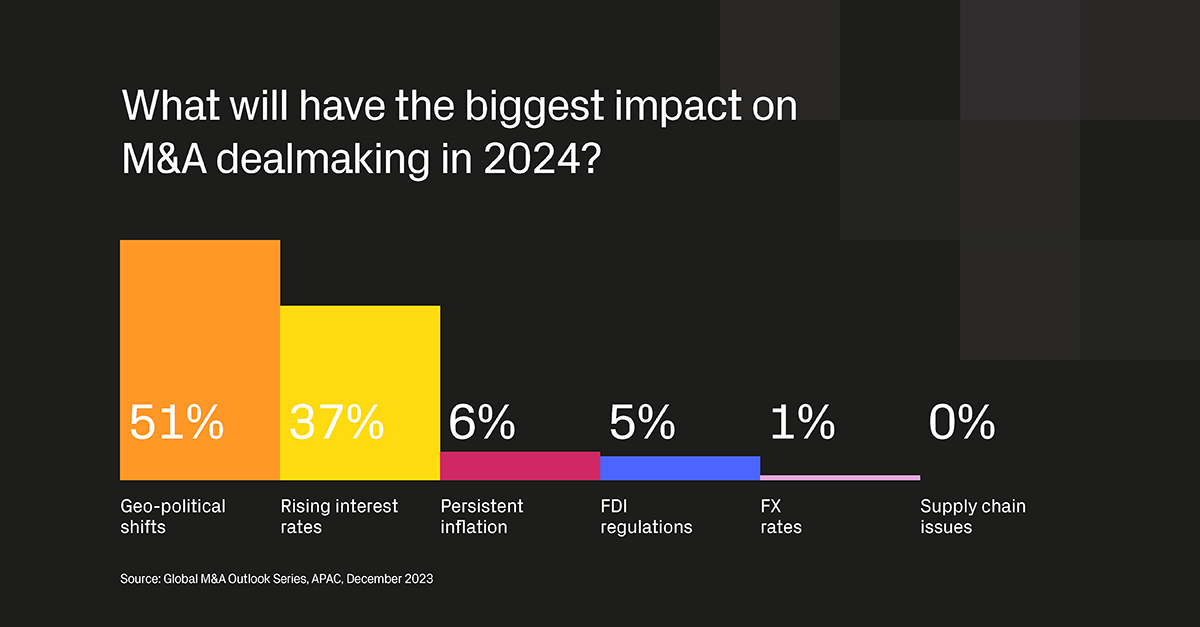

In the present environment, deals are taking longer to close, by 32 extra days on average factoring in the increased time for due diligence. Tougher financing terms are also causing buyers to walk away from nearly half of the deals before completion. This is due to rising geopolitical tensions alongside higher interest rates. Cross-border transactions now face heightened complexity and costs to clear various regulatory hurdles.

The US-China friction has had corporates rethink their Asia exposures. Rather than outright divest China businesses, most are “surgically derisking” – whether relocating certain facilities, tweaking supply chains, or adding deal protections.

India looks increasingly appealing as both corporate and private equity firms moderate their China presence. The Indian government’s incentives in priority sectors such as semiconductors are also bearing fruit – global semiconductor companies have announced over US$13 billion for investment in India lately.

Japan rising

The panelists are bullish about the Japanese market. M&A banker fees have dropped almost everywhere in APAC, while Japan has bucked the trend. Thanks to currency depreciation, global corporates are taking a fresh look at Japan for better valuations and technology capabilities. Local policies urging shareholder activism at cash-rich Japanese corporates are also unlocking more public and private dealmaking lately.

For example, Japan has seen a boom of public companies going private, aided by private equity firms. Overseas private equity shops beyond the usual American suspects have been particularly active in entering Japan over the past year.

Post-COVID demand for hotels, resorts, and other inbound services bodes well for foreign real estate investors. Japanese government backing for startups and overseas VC funding has also boosted technology deal flows.

Long road ahead

However, several obstacles persist for APAC deal completion, according to the panelists. Ongoing US-China tensions force complex negotiations and structures, lest 11th-hour regulatory action jeopardize even “agreed” takeovers.

Upcoming elections in the US, Taiwan, India, and elsewhere further cloud the 2024 picture. Geopolitical volatility could stall deals or weaken buyer confidence until the results shake out.

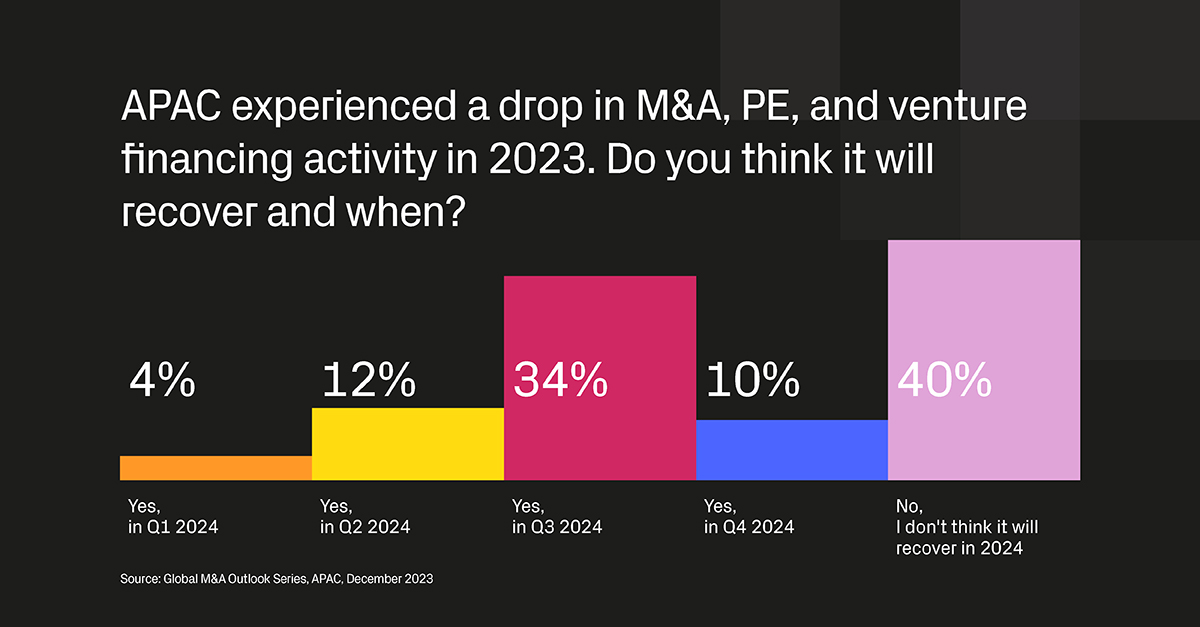

Once peak inflation passes, repressed deal interest should return – first from opportunistic private equity funds, then wider capital markets. Even through an M&A slump in 2023, advisory revenue remained healthy in the background.

Even amidst today’s market churn, Asia Pacific’s structural drivers such as demographics and technology adoption point to long-term dynamism. Savvy executives are mapping out moves today to grasp post-pandemic growth by being deal-ready the moment their clients are ready to go, by capturing and managing opportunities in one place, or by powering their deal research needs with AI. Despite considerable uncertainty today, panelists see green shoots that could blossom further once stability returns. But the path ahead requires patience, creativity, and regional understanding to navigate successfully.

To hear more about strategies for building resilience into dealmaking in 2024, tune in to the webinar replay and get a deeper understanding of insights shared by the panelists, as well as their responses to audience questions about market opportunities across APAC.